Single Family Housing Direct Home Loans Rural Development

Table of Content

Because down payments for USDA loans can be low or zero, youd need to shell out an up-front insurance premium to protect the seller in the event you default. This payment usually measures about 1% to 2% of the loan amount. Youd also need to pay a fee of about 0.35% to 0.40% of the loan throughout the year.

However, for USDA requirements and conditions, about 97% of the country’s land is included in rural development. That’s why an estimated 100 million people can buy a home with the help of this loan. The lender will monitor your income requirements to see if you are eligible for a loan.

What is a USDA loan?

This site is not authorized by the New York State Department of Financial Services. No mortgage loan applications for properties located in the state of New York will be accepted through this site. The last thing most people picture when they hear âUSDAâ is a home loan option with no down payment. Usually, people think of steakâUSDA Prime, USDA Choice, etc. Applicants must have a steady income and enough savings/assets to make mortgage payments for at least 12 months.

In this piece, our focus will be directed towards the Single-Family Housing Guaranteed Loan, which seeks to serve Low to Moderate-income borrowers. These loans may be accessed through third-party private lenders, so you dont have to make your applications directly to the government. The maximum mortgage amount depends on your ability to repay the loan as well as any applicable subsidies or repayment assistance.

What is a USDA Loan?

USDA will not use any payments considered graduated, adjustable, or other repayment types not considered fixed. Therefore, student loans with these characteristics must be calculated at 1% of the balances. Thus, assuming documentation is provided to prove the payment, interest rate, and repayment term are fixed. In reality, this guideline mirrors FHA student loan guidelines. If this guideline causes issues, lets discuss low down payment HomeReady or Home Possible options. Prospective borrowers might also want to research eligibility requirements, particularly in terms of income limits and the area where they’re looking to buy.

What are the usda loan income limits 2022, aUSDA rural development loan is intended for low to moderate income households. Now for 2022 annual household income generally should not exceed $91,900. And that’s for a five to eight member household, but that’s a general estimation. Now in truth, the USDA loan is set at 115% of the area’s media income amount, as well as differ.

What Else Should I Know About USDA Loans and Eligibility?

USDA’s definition of “rural” is looser than you might expect at first. And lenders can sometimes approve applications that are weaker in one area but stronger in another . ContentsRural housing loansSeed money loans fha loans dallas///embed/W9CB-WfJ9skDallas Mortgage Dallas Home Loan Pro

USDA qualifies applicants using income from each adult earner in the household, regardless of whether they’re obligated on the loan. Add each adult’s annual income to find your household’s total annual income to get an idea of where you stand. While you won’t have a down payment, you will still need to have money available to pay for closing costs.

In Nebraska, the income limits for the 504-owner occupied home repair program range from $39,300-$48,250 for a household of 1-4 persons, dependent on household size and county. For the 502 home purchase programs, a household of 1-4 persons, can earn up to $76,100-$111,000; dependent on household size and county. Larger income limits exist for larger families with five to eight members in the household. The borrower’s debt-to-income ratio is required to assess the borrower’s ability to repay the loan. The eligible DTI of the borrower as determined by USDA is 41% or less.

If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Have a household income that does not exceed their county’s “very low income” threshold (50% of the area median income). These loans originate directly from the USDA, with no private lender involved. They are usually reserved for very low-income applicants with extremely generous terms, like 0% down and very low interest rates.

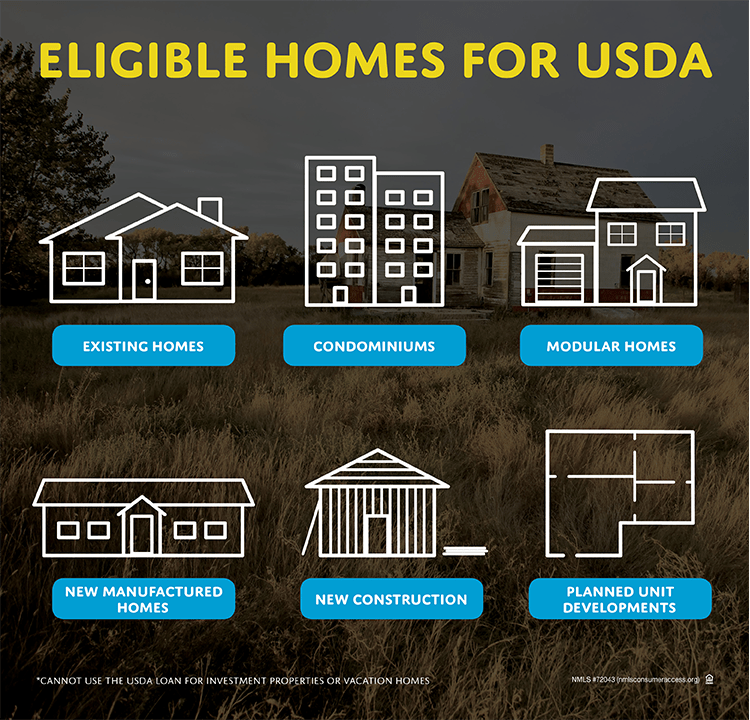

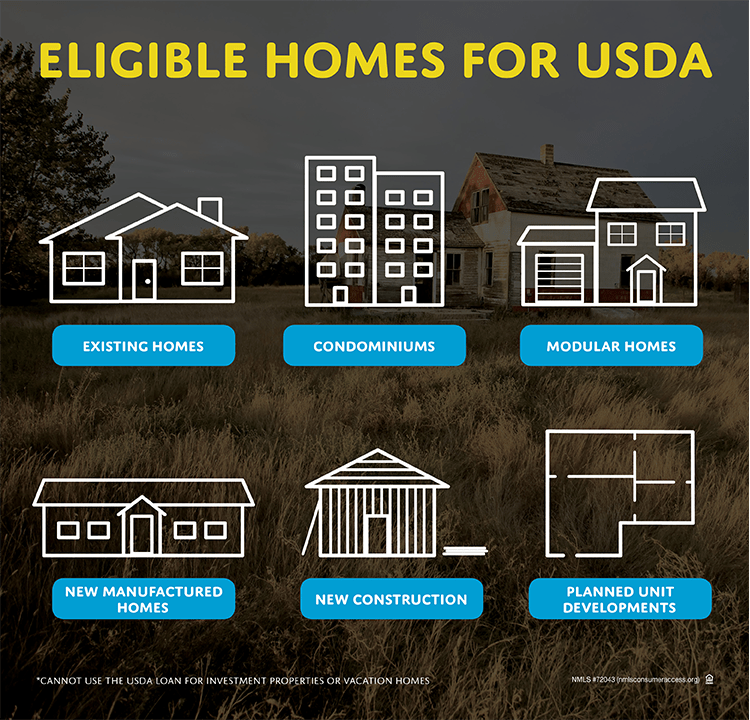

The stipulations are merely in place to ensure that only those that qualify may obtain a mortgage through this type of program. The home you plan to obtain aUSDA mortgagefor must be in eligible locations around the US. Most homes are rural; however, some suburban areas may qualify.

However, if your credit score is 640 or higher, you will receive additional USDA benefits. If the credit score is 640, you will qualify for an automated underwriting system. However, if your credit score is less than 640, you may qualify, but you may have to meet some strict requirements. The lender will ask you for a document of your income and credit history, these necessary documents will prove that you have sufficient capacity and desire to repay the loan.

USDA loans are no down payment home loans guaranteed by the U.S. For homebuyers in eligible areas who meet the income requirements, they are a wonderful option. Out of the monthly payments above, a prevalent situation deals with USDA student loan payment requirements. Unlike Fannie Mae and Freddie Mac loans which allow low, income-based repayment figures, USDA does not.

Only properties within USDA-designated rural areas can be purchased with a USDA home loan. The definition of “rural” doesn’t just mean farmland and homes in very remote areas. There are actually many suburban properties that are eligible for USDA loans as well. Eligibility for the USDA loan program holds you to particular income and credit requirements, as well as requirements for the home you buy.

Comments

Post a Comment