USDA Eligibility and Income Limits 2022 USDA Mortgage

Table of Content

Their income must be included in the annual income for eligibility purposes, according to the USDA guaranteed loan handbook. The current standard USDA loan income limit for 1-4 member households is $103,500. USDA loan limits may be higher to account for areas where housing and earnings are a bit pricier.

For those who receive the earned income tax credit, this amount is not calculated either. This loan is designed to give homebuyers with a modest income the opportunity to become a homeowner. We can help you get the ball rolling on a USDA loan or any other mortgage to get you into your dream property.Contact us todayto learn more. The value of the home can’t exceed the USDA loan limit that applies to the area.

USDA Loan Income Limits and USDA home loan income requirements

There is a yearly fee that is .35% of the loan amount per year broken down into 12 monthly payments. Obtaining a mortgage with no downpayment sounds like a good deal. With USDA loans, you can get low rates even with a less than perfect credit score. This mean you can make additional payments to pay your mortgage faster.

The USDA single-family housing guaranteed program is partially funded by borrowers who use USDA loans. USDA’s goal is to help moderate to low-income buyers become homeowners. So if you meet the basic criteria — or you’re close — check your eligibility with a lender. The USDA loan program is one of the best mortgage loans available for qualifying borrowers. Annual family income is the total expected income of the adults in your household. The income of the adult family member is included in the family income limit.

Single Family Housing Direct Home Loans

Because down payments for USDA loans can be low or zero, youd need to shell out an up-front insurance premium to protect the seller in the event you default. This payment usually measures about 1% to 2% of the loan amount. Youd also need to pay a fee of about 0.35% to 0.40% of the loan throughout the year.

Some of your income won’t count toward the income limit for a USDA loan that includes payments for children. Section eight vouchers for rent financial aid and inheritances further. Additionally, your lender may ask you to establish what’s called a non-traditional tradeline.

Credit Rate and DTI

You won’t wanna miss any of them, finally, if you’d like our free real estate home buying or home selling guide, head over to your house. Since the USDA loan program is geared toward those with a low to moderate household income, you may think there’s a limit on what home you can purchase. However, the USDA does not have loan limits in terms of the purchase amount, but they do base the maximum loan amount on what you’re able to qualify for. The current standard USDA loan income limits for a household of one to four people is $90,300. For a five to eight-member household, the limit is a bit higher at $119,200.

USDA eligible properties have to be part of a rural area, so things like population size and even city limits matter. If you’re someone who makes at or below the average salary of your area, then you could potentially qualify for a USDA loan to help you buy a house in a rural part of the United States. Borrowers are required to repay all or a portion of the payment subsidy received over the life of the loan when the title to the property transfers or the borrower is no longer living in the dwelling. In some cases, the USDA offers an exception to income that’s counted toward yourUSDA loanincome limit. For example, if your minor child has a job, their earned income will not be counted.

USDA Loan & Credit Requirements - USDA Homes

If you’re still struggling with determining the eligibility of a home, then you cancontact a USDA loan advisortoo! Even if an area isn’t designated as rural because of a Census, or it’s lost its rural title, then it can still be considered for USDA eligibility. There are no other additional requirements at the national level. If there are additional state-specific requirements they will be listed above. If you’re interested in discussing a new mortgage or need more information, be sure tovisit our websiteto find out more today. If there is an adult full-time student in the home, the USDA does not count income in excess of $480.

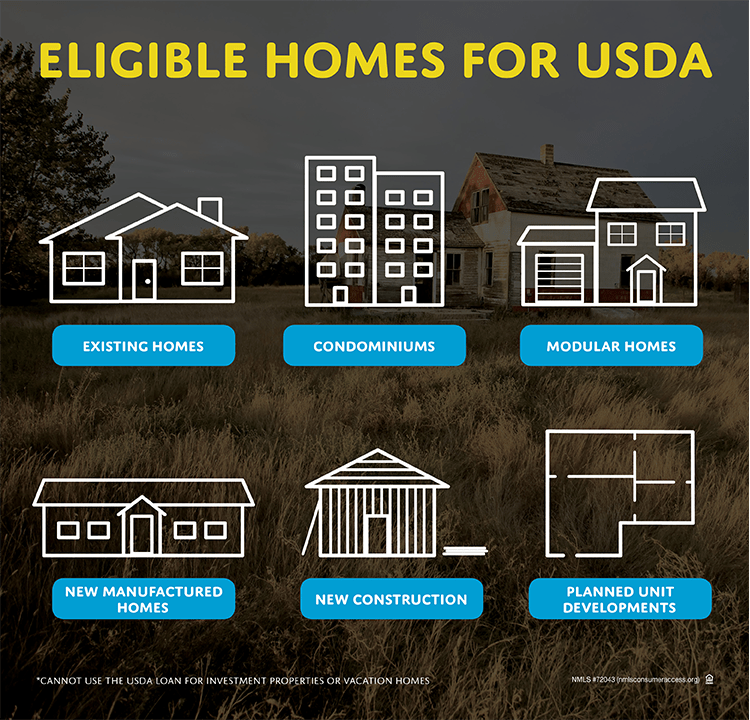

The stipulations are merely in place to ensure that only those that qualify may obtain a mortgage through this type of program. The home you plan to obtain aUSDA mortgagefor must be in eligible locations around the US. Most homes are rural; however, some suburban areas may qualify.

Otherwise your loan will be, need to be manually underwritten note that you must meet both the income limit and the. Requirements you can’t purchase just any property with the USDA rural development loan. Discover how many properties actually qualify as rural. USDA loans provide an affordable financing option for low-to-moderate-income homebuyers.

It could be easier than you think to qualify for a home loan via the USDA program. Check your eligibility with a USDA-approved lender today. As a real-life example of how USDA mortgage insurance works, let’s say that a home buyer in rural Franklin County, New York is borrowing a loan amount of $200,000 to buy a home with no money down.

Comments

Post a Comment